Why Invest in Government Bonds in 2025?

Government bonds, particularly U.S. Treasury securities, provide guaranteed interest payments backed by the federal government. They are ideal for risk-averse investors who prioritize capital preservation and steady returns.

Top Government Bonds to Consider in 2025:

U.S. Treasury Bonds (T-Bonds) – Best for Long-Term Stability

✅ 10- to 30-year maturities

✅ Fixed interest rates backed by the U.S. government

✅ Best for conservative, long-term investors

Treasury Inflation-Protected Securities (TIPS) – Best for Inflation Protection

✅ Adjusted for inflation, ensuring real value preservation

✅ Pays interest every six months

✅ Ideal for investors worried about rising inflation

U.S. Treasury Bills (T-Bills) – Best for Short-Term Safety

✅ Maturity periods of 4 weeks to 1 year

✅ Zero-coupon bonds that offer guaranteed returns

✅ Low risk, suitable for cash-equivalent investments

Municipal Bonds (Muni Bonds) – Best for Tax-Free Income

✅ Issued by state and local governments

✅ Interest payments are often tax-exempt

✅ Great for retirees and high-income earners

Savings Bonds (I Bonds) – Best for Individuals Seeking Secure Growth

✅ Backed by the U.S. Treasury

✅ Interest rates adjusted for inflation

✅ No risk of principal loss

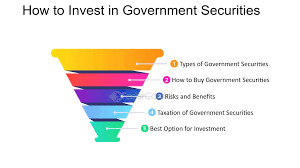

How to Choose the Right Government Bond?

Investment Horizon – Choose T-bills for short-term goals, T-bonds for long-term security.

Risk Tolerance – Even within government bonds, TIPS protect against inflation, while munis offer tax benefits.

Interest Rates – Consider the current interest rate environment before buying long-term bonds.

Investment Strategies for Government Bonds in 2025:

Share This News