Big Tech Faces New Tax Proposals as Congress Pushes for Greater Contributions

Congress is pushing for new tax proposals aimed at Big Tech companies, seeking increased contributions to federal revenue. Lawmakers argue that major tech firms benefit from U.S. infrastructure but pay disproportionately low taxes. The proposed reforms could reshape corporate tax obligations in the digital economy

The U.S. Congress is moving forward with a series of tax proposals aimed at major technology corporations, signaling a shift toward higher corporate tax contributions. With tech giants such as Apple, Amazon, Google, and Meta generating billions in revenue, lawmakers argue that these companies must pay a fairer share to support national economic initiatives.

Key Tax Proposals and Their Implications

Minimum Corporate Tax Rate for Big Tech

A proposed 15% minimum corporate tax rate would prevent large tech firms from using loopholes to lower their tax obligations. This measure aligns with global tax reform efforts to ensure multinational corporations pay equitable taxes across jurisdictions.Digital Services Tax (DST)

Lawmakers are considering a 3% tax on digital advertising revenue, impacting companies like Google, Meta, and Amazon. This proposal mirrors similar digital taxes introduced in Europe, Canada, and Australia.Closing Offshore Tax Loopholes

The Biden administration is pushing to eliminate offshore tax havens, ensuring that profits generated in the U.S. are taxed domestically. Companies that shift profits to low-tax jurisdictions like Ireland and Bermuda could face stricter tax regulations.Stock Buyback Tax Increase

The current 1% tax on stock buybacks may increase to 4%, discouraging large-scale buyback programs used by tech firms to inflate stock prices. Lawmakers argue that increasing the tax would encourage companies to invest in innovation and workforce expansion instead.AI and Cloud Computing Taxes

As artificial intelligence and cloud services become dominant revenue sources, Congress is exploring new taxation models for these sectors. Proposals suggest additional levies on AI-generated content and cloud infrastructure usage by large enterprises.Impact on Tech Companies and the Economy

Higher Tax Liabilities: Companies may need to adjust financial strategies to account for higher taxation. Investment in Compliance: More stringent tax laws could increase regulatory compliance costs for tech firms. Consumer Price Implications: Higher taxes might lead to increased service costs for consumers and businesses relying on digital platforms. Government Revenue Boost: Additional tax revenue could support infrastructure, social programs, and national debt reduction efforts.Industry Response and Potential Legal Challenges

Major tech companies have expressed concerns over the proposed tax changes, arguing that:

Higher taxes may stifle innovation and investment in emerging technologies. A digital services tax could create double taxation issues, as companies already pay taxes in multiple jurisdictions. Stock buyback tax increases could reduce shareholder value, impacting market confidence.Tech industry groups are expected to lobby against the proposals and explore legal challenges if the legislation is enacted.

Future Outlook: Will These Tax Measures Pass?

The success of these proposals depends on Congressional negotiations, bipartisan support, and corporate lobbying efforts. With an election year approaching, tax reform could become a key policy issue, influencing voter sentiment on economic fairness and corporate responsibility

Latest In Media & marketing

Banking Magazine

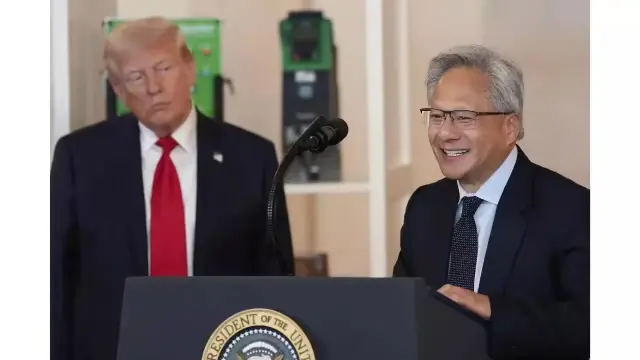

Nvidia CEO Frustrated by Delays in Trump’s UAE Chips Deal

Investment

Dubai Police Expands Fleet with Three New Mercedes Patrol Cars

Finance

UAE President Meets OpenAI CEO to Strengthen AI Ties

Money