trending

neon

Cirque du Soleil offers summer ticket deals

dining out

Celebs ditch the Strip for iconic Henderson restaurant

july

trending

neon

Cirque du Soleil offers summer ticket deals

dining out

Celebs ditch the Strip for iconic Henderson restaurant

july

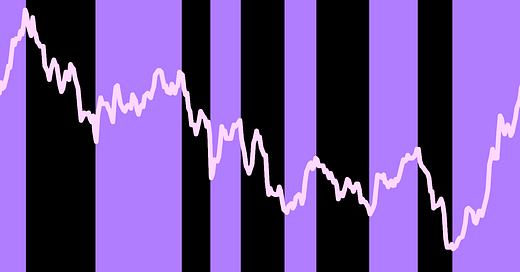

Higher interest rates often trigger fears of a market downturn, but historical data suggests otherwise. While some sectors face challenges, others thrive in a high-rate environment. Investors should focus on strategic allocation rather than panic selling

Rising interest rates have historically been associated with stock market volatility, prompting fears of declining equity prices. Investors often worry that higher borrowing costs, reduced consumer spending, and tighter monetary policies will slow corporate growth and hurt stock valuations. However, history suggests that while rising rates pose challenges, they do not necessarily doom the stock market.

In fact, certain sectors benefit from higher interest rates, and stocks can still perform well under tighter financial conditions. The key for investors is to understand which industries thrive, how historical trends play out, and what strategies can help navigate this changing economic landscape.

The Federal Reserve (Fed) plays a central role in setting interest rates as part of its monetary policy to control inflation and economic growth. When inflation rises too quickly, the Fed increases interest rates to slow down borrowing and spending.

However, this does not mean that stock markets always decline when rates rise. The overall impact depends on economic conditions, corporate earnings, and investor sentiment.

Looking at past rate-hike cycles, we see mixed results. Some market corrections have followed interest rate increases, but in many cases, stocks have continued to rise.

✅ 1980s-1990s: Despite multiple rate hikes, the stock market performed strongly due to robust economic growth. ✅ 2004-2006: The Fed raised rates 17 times, yet the S&P 500 still posted gains. ⚠️ 2015-2018: Gradual hikes initially led to strong stock performance, but late-cycle hikes contributed to a market downturn in 2018.

The takeaway? Stock market declines depend more on economic conditions than rate hikes alone. If growth remains strong, companies can absorb higher borrowing costs and continue expanding.

Higher interest rates often trigger fears of a market downturn, but historical data suggests otherwise. While some sectors face challenges, others thrive in a high-rate environment. Investors should focus on strategic allocation rather than panic selling

the latest

Gulf Markets Rise on U.S. Rate Cut Hopes Despite Trade Risks

Major Gulf stock markets ended higher, boosted by optimism over potential U.S. Federal Reserve rate cuts, although ongoing global trade tensions continue to weigh on investor sentiment.

Reeves Weighs Tax Increases & Spending Cuts in November Budget

UK Finance Minister Rachel Reeves is reportedly preparing to raise taxes and cut spending in the the upcoming November budget to address rising borrowing costs and shrink the fiscal deficit.

UK Plans Easier Visa Path to Attract Global Talent: Reeves

UK Finance Minister Rachel Reeves announced plans to ease visa rules to attract top global talent, following Trump’s U.S. visa restrictions.

UAE Urges Netanyahu to Support Trump Gaza Peace Plan

The UAE pressed Israeli Prime Minister Benjamin Netanyahu to support Donald Trump’s Gaza peace plan and warned against annexation of the West Bank.

UK Inflation Slows, Oil Price Rise Creates New BoE Challenge

UK inflation eased slightly, but a sudden oil price surge has raised new concerns for the Bank of England as it balances growth, rates, and stability.

UAE Rate Cut Boosts Dubai and Abu Dhabi Stock Markets

Dubai and Abu Dhabi shares rose after the UAE central bank cut interest rates, boosting investor sentiment and signaling support for economic growth.

Meedaf Partners with InDebted to Expand UAE Operations

Fintech company Meedaf has partnered with InDebted to facilitate its expansion into the UAE, leveraging advanced debt collection and customer engagement solutions to strengthen regional operations.

Banker & Ex-Gov. Plead Guilty in Bancrédito Bribery Case

Former Puerto Rico Governor Wanda Vázquez and banker Julio Herrera Velutini have pleaded guilty to campaign finance violations linked to the Bancrédito scandal.

Visa Launches Visa Private in UAE for High-Net-Worth Clients

Visa has launched Visa Private in the UAE, a premium service designed for high-net-worth clients, offering tailored financial solutions, exclusive benefits, and concierge services.