UAE Stocks Mixed on Weak Oil, Gaza Ceasefire Optimism

UAE stock markets showed mixed performance as weak oil prices offset optimism over a potential Gaza ceasefire. Investors weighed global energy market pressures against hopes for regional stability.

First 200 MW of UAE Stargate AI Campus to Go Live Next Year

Dubai Bans Power Banks on Flights, Updates Visa and Safety Rules

BoE’s Alan Taylor Warns UK Economy Faces “Bumpy Landing

Reeves Weighs Tax Increases & Spending Cuts in November Budget

TOP ENTERTAINMENT PICKS

Free

Shows

Shows

Shows

Shows

The Latest

UK Winter Energy Supply Seen as Secure Despite Tight Gas Margins

UK grid operators say that, though gas supply margins are tighter due to falling domestic production, the country's gas and electricity systems are expected to remain reliable this winter.

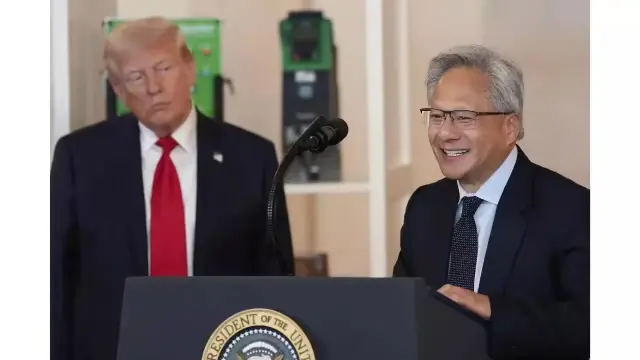

US Approves Billions in Nvidia AI Chip Sales to UAE

The U.S. Commerce Department has granted export licenses for several billion dollars’ worth of Nvidia AI chips to the UAE under a bilateral AI agreement, Bloomberg reports.

Gulf Markets End Mixed on Oil Prices and US Rate Cut Hopes

Gulf markets closed mixed as investors weighed rising oil prices against optimism over a potential U.S. rate cut, impacting stocks in Dubai, Abu Dhabi, and Riyadh.

Nvidia CEO Frustrated as U.S. Delays UAE AI Chip Deal

Nvidia CEO Jensen Huang has voiced frustration over delays in the UAE’s AI chip deal, reportedly caused by U.S. pressure. The delay risks slowing regional AI expansion and complicating U.S.-UAE tech diplomacy.

Nvidia CEO Frustrated Over UAE AI Chip Deal Delay

Nvidia CEO Jensen Huang expressed frustration over delays in a major AI chip deal with the UAE, citing pressure from U.S. export regulations affecting the agreement.

UAE Highlights Climate, Security, and Business Initiatives

The UAE government emphasized sustainability, regional security, and economic growth in recent national headlines, showcasing its commitment to long-term development and stability.

Starmer’s India Visit Seeks to Boost Trade Deal Impact

British Prime Minister Keir Starmer begins a two‐day India visit with over 100 UK business and academic leaders to promote the recently signed UK-India free trade agreement aimed at boosting exports and investment.

UAE to Tax Sugary Drinks Starting January 2026

The UAE government will implement a sugar-level tax on beverages starting January 2026, targeting soft drinks, juices, and energy drinks to encourage healthier consumption.

UAE Reaches 640,000 Corporate Tax Registrations

The UAE has reached 640,000 corporate tax registrations as the Federal Tax Authority reports record filings and announces deadline relief for businesses.

UAE Introduces New Visit Visas for AI, Cruises, Events

The UAE government has launched four new specialized visit visas targeting professionals and visitors in AI, cruise tourism, events, and entertainment sectors to boost business and tourism.

October 6, 2025

UAE National Month Campaign to Celebrate Flag Day, Unity

The UAE will run a month-long national campaign from November 3 to December 2, highlighting heritage, unity, and patriotism in line with Flag Day and National Day celebrations.

More News

Countdown to Nominations

Most read

Sponsored By One Nevada Credit Union