trending

neon

Cirque du Soleil offers summer ticket deals

dining out

Celebs ditch the Strip for iconic Henderson restaurant

july

trending

neon

Cirque du Soleil offers summer ticket deals

dining out

Celebs ditch the Strip for iconic Henderson restaurant

july

As interest rates fall, investors are finding new stock opportunities. Experts suggest this trend could drive market growth in key sectors

As central banks adjust monetary policies to counter economic shifts, a significant drop in interest rates is reshaping investment landscapes worldwide. Investors are now eyeing new stock opportunities across various sectors, leveraging lower borrowing costs and improved corporate profitability.

Interest rates play a crucial role in financial markets, influencing everything from corporate borrowing to consumer spending. When rates decline, companies can secure cheaper loans, leading to increased investments in expansion, innovation, and acquisitions. This stimulates economic growth, boosting investor confidence and pushing stock prices higher.

Historically, lower interest rates have been correlated with bullish market trends. With borrowing costs reduced, both businesses and consumers tend to spend more, fueling demand and enhancing corporate earnings. This scenario creates attractive opportunities in equity markets, especially in interest-sensitive industries.

Technology: The tech industry thrives on innovation and investment. Lower interest rates encourage firms to invest in research, product development, and market expansion. Companies like Apple, Microsoft, and emerging startups stand to gain from increased consumer spending and investor enthusiasm.

Real Estate: Mortgage rates tend to follow broader interest rate trends. As borrowing becomes more affordable, real estate investments surge. Developers can finance projects at lower costs, while homebuyers take advantage of reduced mortgage payments. Real estate investment trusts (REITs) also become attractive in such environments.

Financial Services: While banks may see lower profit margins on loans, asset management firms, fintech companies, and brokerage firms experience increased activity. Lower rates make equities more appealing than fixed-income investments, driving up trading volumes and investment inflows.

Consumer Discretionary: With reduced borrowing costs and improved consumer confidence, discretionary spending on goods and services rises. Retailers, automotive manufacturers, and travel-related companies see increased revenues, boosting stock performance.

Utilities and Dividend Stocks: Investors seeking stable returns turn to dividend-paying stocks, especially in the utilities sector. Lower interest rates make these stocks more attractive compared to bonds, driving up their valuations.

Investors looking to capitalize on falling interest rates should consider the following strategies:

As central banks worldwide maintain an accommodative stance, analysts predict a prolonged period of low interest rates. The Federal Reserve, European Central Bank (ECB), and other major financial institutions continue implementing monetary easing policies to stimulate economic recovery.

Despite concerns over inflation and geopolitical uncertainties, the overall market sentiment remains optimistic. Institutional investors, hedge funds, and retail traders are adjusting portfolios to take advantage of favorable interest rate dynamics.

While lower interest rates present lucrative opportunities, investors must remain cautious about potential risks:

As interest rates fall, investors are finding new stock opportunities. Experts suggest this trend could drive market growth in key sectors

the latest

UAE Foreign Minister Calls for Gaza Ceasefire in Talks with Netanyahu

UAE Foreign Minister Sheikh Abdullah bin Zayed met Israeli Prime Minister Benjamin Netanyahu on the sidelines of the UN General Assembly in New York, urging an immediate end to the Gaza conflict and highlighting the urgent need for a sustainable ceasefire.

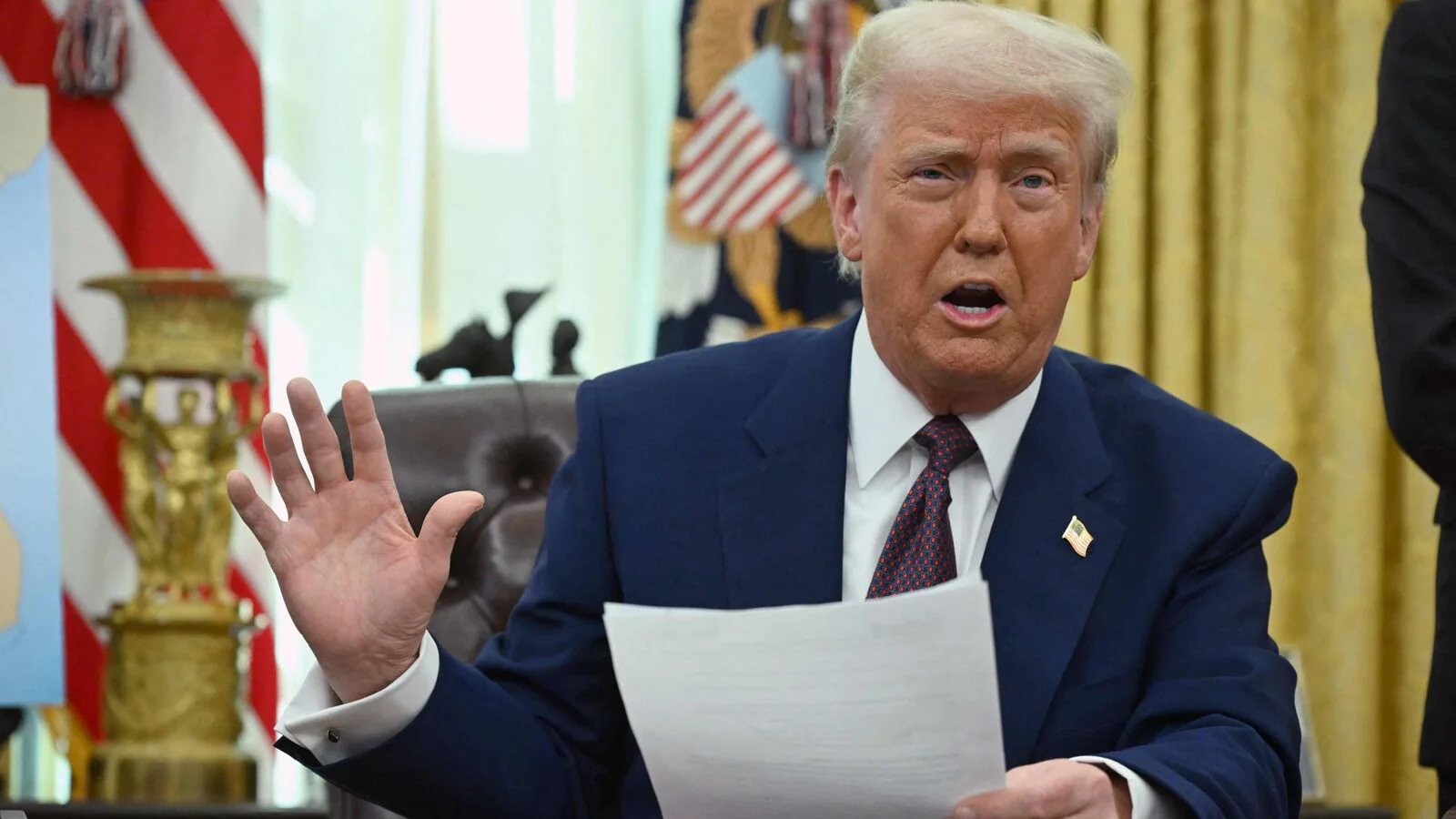

Details Emerge on Trump’s $5M ‘Gold Card’ Visa Plan

Donald Trump’s proposed $5 million "Gold Card" visa seeks to attract high-net-worth individuals to the U.S., promising economic growth and investment opportunities

Trump Administration Previews New Investment Restrictions

The Trump administration has introduced new investment restrictions to protect U.S. businesses and national security. The policy focuses on limiting foreign investments in key industries, especially from adversarial nations like China and Russia, while encouraging domestic economic growth

Trump Administration Unveils ‘America First’ Investment Policy

The Trump administration has introduced the "America First Investment Policy" to tighten foreign investment regulations, safeguard national security, and prioritize U.S. economic growth. The policy aims to restrict investments from certain countries while encouraging domestic reinvestment

CFIUS Tightens Rules on Foreign Investments in the U.S

The Committee on Foreign Investment in the United States (CFIUS) has introduced stricter regulations targeting investments from specific countries, citing national security concerns

White House Releases 'America First Investment Policy' Memo

The White House has unveiled its latest initiative, the 'America First Investment Policy' memo, outlining strategies to attract foreign capital while prioritizing domestic industries. The policy aims to enhance job creation, boost American businesses, and redefine trade relations to favor U.S. economic interests

Trump's Tariffs Unleash Investor Uncertainty: Next Steps

Former President Donald Trump's latest round of tariffs has sent shockwaves through global markets, leaving investors grappling with increased uncertainty. With businesses facing higher costs and trade tensions escalating, analysts weigh in on the long-term implications for industries, financial markets, and economic stability

Trump's Red Carpet Plan for Wealthy Foreign Investors

Former President Donald Trump is pushing a new visa policy that offers wealthy foreign investors a fast-tracked path to U.S. residency. The plan, dubbed the "Gold Card" visa, requires a $5 million investment in key industries but faces criticism for favoring the ultra-rich

How Trump’s $5M ‘Gold Card’ for Rich Migrants Works

Donald Trump’s proposed $5 million "Gold Card" visa seeks to fast-track residency for wealthy investors, aiming to boost the U.S. economy through capital inflows