trending

neon

Cirque du Soleil offers summer ticket deals

dining out

Celebs ditch the Strip for iconic Henderson restaurant

july

trending

neon

Cirque du Soleil offers summer ticket deals

dining out

Celebs ditch the Strip for iconic Henderson restaurant

july

The iShares 0-5 Year Investment Grade Corporate Bond ETF (SLQD) is a low-risk option for investors. Learn how U.S. investment policies influence its performance

The iShares 0-5 Year Investment Grade Corporate Bond ETF (SLQD) is a popular choice among investors looking for short-term, investment-grade corporate bond exposure. Given its focus on lower-duration securities, SLQD provides stability and income generation while minimizing interest rate risk.

However, the performance of SLQD is directly influenced by U.S. investment policies, particularly those related to interest rates, fiscal policy, bond market regulations, and credit standards. Understanding these policies is essential for investors seeking to optimize their fixed-income portfolios.

Short-Term Investment-Grade Bonds

Lower Interest Rate Sensitivity

Diversified Corporate Debt Holdings

The Federal Reserve (Fed) plays a significant role in shaping the corporate bond market.

The Fed’s 2024 policy outlook indicates a cautious approach, balancing inflation control with economic growth. This affects corporate bond yields, ETF performance, and investor sentiment.

Inflation impacts bond yields and investor behavior. If inflation remains high:

Conversely, if inflation stabilizes, corporate bond ETFs like SLQD maintain steady returns with lower risk.

The U.S. government’s bond market regulations and corporate tax policies directly impact SLQD. Key policy influences include:

The iShares 0-5 Year Investment Grade Corporate Bond ETF (SLQD) is a low-risk option for investors. Learn how U.S. investment policies influence its performance

the latest

UAE Foreign Minister Calls for Gaza Ceasefire in Talks with Netanyahu

UAE Foreign Minister Sheikh Abdullah bin Zayed met Israeli Prime Minister Benjamin Netanyahu on the sidelines of the UN General Assembly in New York, urging an immediate end to the Gaza conflict and highlighting the urgent need for a sustainable ceasefire.

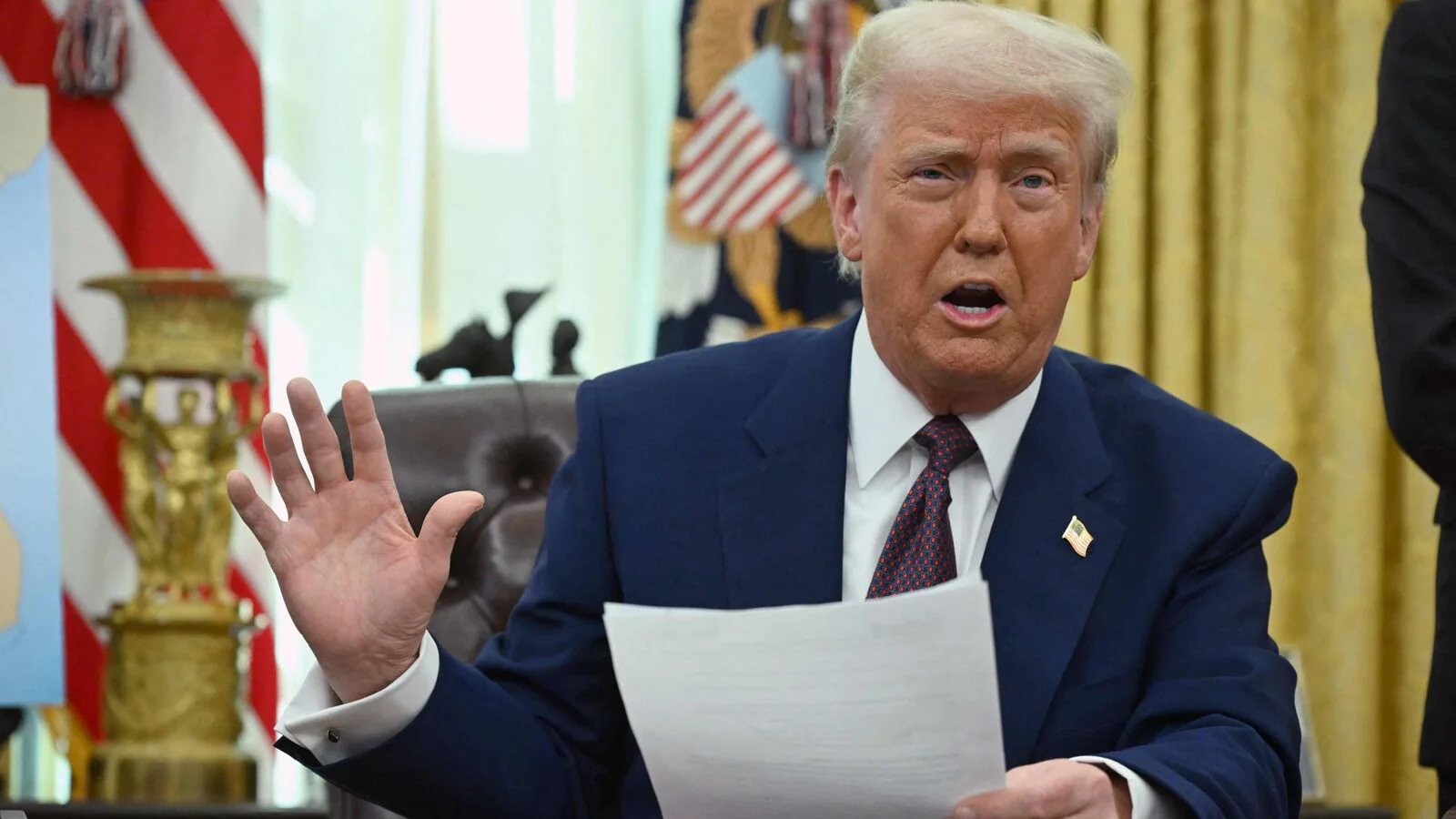

Details Emerge on Trump’s $5M ‘Gold Card’ Visa Plan

Donald Trump’s proposed $5 million "Gold Card" visa seeks to attract high-net-worth individuals to the U.S., promising economic growth and investment opportunities

Trump Administration Previews New Investment Restrictions

The Trump administration has introduced new investment restrictions to protect U.S. businesses and national security. The policy focuses on limiting foreign investments in key industries, especially from adversarial nations like China and Russia, while encouraging domestic economic growth

Trump Administration Unveils ‘America First’ Investment Policy

The Trump administration has introduced the "America First Investment Policy" to tighten foreign investment regulations, safeguard national security, and prioritize U.S. economic growth. The policy aims to restrict investments from certain countries while encouraging domestic reinvestment

CFIUS Tightens Rules on Foreign Investments in the U.S

The Committee on Foreign Investment in the United States (CFIUS) has introduced stricter regulations targeting investments from specific countries, citing national security concerns

White House Releases 'America First Investment Policy' Memo

The White House has unveiled its latest initiative, the 'America First Investment Policy' memo, outlining strategies to attract foreign capital while prioritizing domestic industries. The policy aims to enhance job creation, boost American businesses, and redefine trade relations to favor U.S. economic interests

Trump's Tariffs Unleash Investor Uncertainty: Next Steps

Former President Donald Trump's latest round of tariffs has sent shockwaves through global markets, leaving investors grappling with increased uncertainty. With businesses facing higher costs and trade tensions escalating, analysts weigh in on the long-term implications for industries, financial markets, and economic stability

Trump's Red Carpet Plan for Wealthy Foreign Investors

Former President Donald Trump is pushing a new visa policy that offers wealthy foreign investors a fast-tracked path to U.S. residency. The plan, dubbed the "Gold Card" visa, requires a $5 million investment in key industries but faces criticism for favoring the ultra-rich

How Trump’s $5M ‘Gold Card’ for Rich Migrants Works

Donald Trump’s proposed $5 million "Gold Card" visa seeks to fast-track residency for wealthy investors, aiming to boost the U.S. economy through capital inflows