trending

neon

Cirque du Soleil offers summer ticket deals

dining out

Celebs ditch the Strip for iconic Henderson restaurant

july

trending

neon

Cirque du Soleil offers summer ticket deals

dining out

Celebs ditch the Strip for iconic Henderson restaurant

july

U.S. equities continue to outperform, driven by strong earnings, economic resilience, and innovation. Investors remain bullish on long-term market growth

U.S. equities have long been a pillar of global investment portfolios, offering strong returns, innovation-driven growth, and economic resilience. Despite economic uncertainties, market volatility, and global competition, many analysts continue to advocate an overweight position in U.S. stocks.

But why should investors maintain confidence in U.S. equities? This article explores key reasons why the U.S. stock market remains an attractive investment destination and why maintaining an overweight position could be a winning strategy.

Risks to Watch While there are compelling reasons to remain overweight in U.S. stocks, investors should also be aware of potential risks:

U.S. equities continue to outperform, driven by strong earnings, economic resilience, and innovation. Investors remain bullish on long-term market growth

the latest

UAE Foreign Minister Calls for Gaza Ceasefire in Talks with Netanyahu

UAE Foreign Minister Sheikh Abdullah bin Zayed met Israeli Prime Minister Benjamin Netanyahu on the sidelines of the UN General Assembly in New York, urging an immediate end to the Gaza conflict and highlighting the urgent need for a sustainable ceasefire.

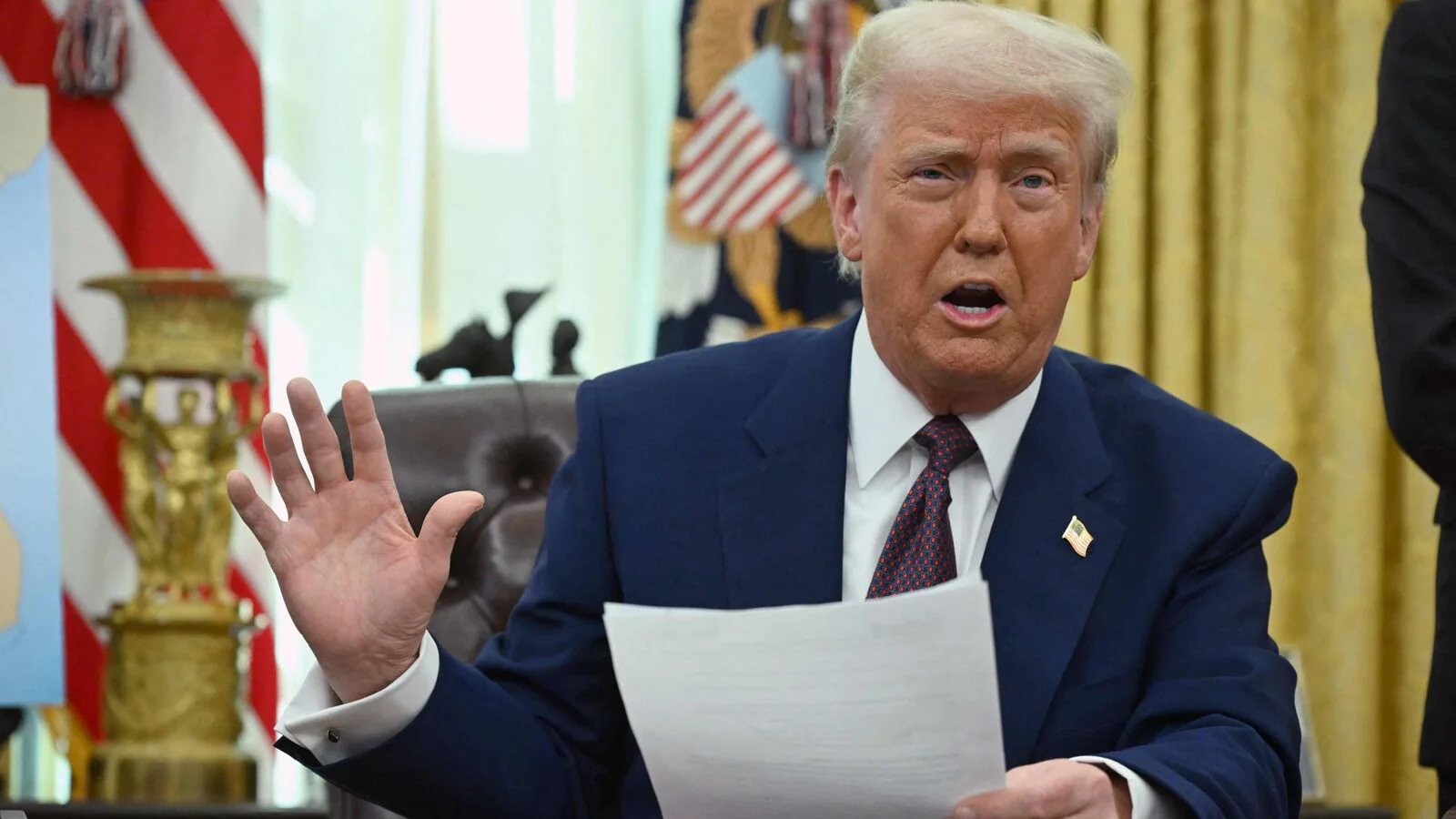

Details Emerge on Trump’s $5M ‘Gold Card’ Visa Plan

Donald Trump’s proposed $5 million "Gold Card" visa seeks to attract high-net-worth individuals to the U.S., promising economic growth and investment opportunities

Trump Administration Previews New Investment Restrictions

The Trump administration has introduced new investment restrictions to protect U.S. businesses and national security. The policy focuses on limiting foreign investments in key industries, especially from adversarial nations like China and Russia, while encouraging domestic economic growth

Trump Administration Unveils ‘America First’ Investment Policy

The Trump administration has introduced the "America First Investment Policy" to tighten foreign investment regulations, safeguard national security, and prioritize U.S. economic growth. The policy aims to restrict investments from certain countries while encouraging domestic reinvestment

CFIUS Tightens Rules on Foreign Investments in the U.S

The Committee on Foreign Investment in the United States (CFIUS) has introduced stricter regulations targeting investments from specific countries, citing national security concerns

White House Releases 'America First Investment Policy' Memo

The White House has unveiled its latest initiative, the 'America First Investment Policy' memo, outlining strategies to attract foreign capital while prioritizing domestic industries. The policy aims to enhance job creation, boost American businesses, and redefine trade relations to favor U.S. economic interests

Trump's Tariffs Unleash Investor Uncertainty: Next Steps

Former President Donald Trump's latest round of tariffs has sent shockwaves through global markets, leaving investors grappling with increased uncertainty. With businesses facing higher costs and trade tensions escalating, analysts weigh in on the long-term implications for industries, financial markets, and economic stability

Trump's Red Carpet Plan for Wealthy Foreign Investors

Former President Donald Trump is pushing a new visa policy that offers wealthy foreign investors a fast-tracked path to U.S. residency. The plan, dubbed the "Gold Card" visa, requires a $5 million investment in key industries but faces criticism for favoring the ultra-rich

How Trump’s $5M ‘Gold Card’ for Rich Migrants Works

Donald Trump’s proposed $5 million "Gold Card" visa seeks to fast-track residency for wealthy investors, aiming to boost the U.S. economy through capital inflows