trending

neon

Cirque du Soleil offers summer ticket deals

dining out

Celebs ditch the Strip for iconic Henderson restaurant

july

trending

neon

Cirque du Soleil offers summer ticket deals

dining out

Celebs ditch the Strip for iconic Henderson restaurant

july

Congress is pushing for new tax proposals aimed at Big Tech companies, seeking increased contributions to federal revenue. Lawmakers argue that major tech firms benefit from U.S. infrastructure but pay disproportionately low taxes. The proposed reforms could reshape corporate tax obligations in the digital economy

The U.S. Congress is moving forward with a series of tax proposals aimed at major technology corporations, signaling a shift toward higher corporate tax contributions. With tech giants such as Apple, Amazon, Google, and Meta generating billions in revenue, lawmakers argue that these companies must pay a fairer share to support national economic initiatives.

Minimum Corporate Tax Rate for Big Tech

Digital Services Tax (DST)

Closing Offshore Tax Loopholes

Stock Buyback Tax Increase

AI and Cloud Computing Taxes

Major tech companies have expressed concerns over the proposed tax changes, arguing that:

Tech industry groups are expected to lobby against the proposals and explore legal challenges if the legislation is enacted.

The success of these proposals depends on Congressional negotiations, bipartisan support, and corporate lobbying efforts. With an election year approaching, tax reform could become a key policy issue, influencing voter sentiment on economic fairness and corporate responsibility

Congress is pushing for new tax proposals aimed at Big Tech companies, seeking increased contributions to federal revenue. Lawmakers argue that major tech firms benefit from U.S. infrastructure but pay disproportionately low taxes. The proposed reforms could reshape corporate tax obligations in the digital economy

the latest

Cerebras to Deploy AI Infrastructure at UAE Stargate Campus

Cerebras Systems, a leading AI hardware company, announced plans to deploy its advanced AI infrastructure at the UAE’s Stargate data campus.

US Approves Nvidia AI Chip Sales to UAE Amid Export Curbs

The U.S. government has authorized certain Nvidia AI chip exports to the United Arab Emirates, easing restrictions imposed under Washington’s export control policies. The decision signals a balancing act between U.S. security concerns and the UAE’s growing role in global AI development.

US Approves Billions in Nvidia AI Chip Sales to UAE

The U.S. Commerce Department has granted export licenses for several billion dollars’ worth of Nvidia AI chips to the UAE under a bilateral AI agreement, Bloomberg reports.

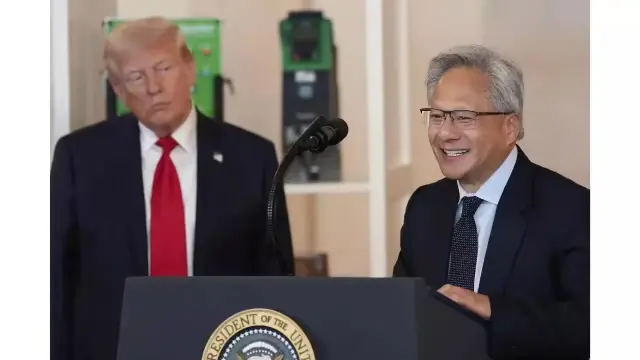

Nvidia CEO Frustrated as U.S. Delays UAE AI Chip Deal

Nvidia CEO Jensen Huang has voiced frustration over delays in the UAE’s AI chip deal, reportedly caused by U.S. pressure. The delay risks slowing regional AI expansion and complicating U.S.-UAE tech diplomacy.

Trump’s UAE Chip Deal Delays Frustrate Nvidia’s Jensen Huang

Nvidia CEO Jensen Huang expressed frustration over delays in the Trump-backed UAE chip deal, raising concerns over AI and semiconductor expansion.

UAE President, OpenAI CEO Discuss AI Collaboration Plans

UAE President Sheikh Mohamed bin Zayed met OpenAI CEO Sam Altman to explore collaboration in AI, aiming to boost innovation and digital transformation.

Nvidia CEO Frustrated by Delays in Trump’s UAE Chips Deal

Delays in Donald Trump’s UAE chip deal have left Nvidia CEO Jensen Huang frustrated, raising concerns about global chip supply chains and AI ambitions.

Ericsson, Nokia Secure $2.7B VodafoneThree UK Deal

VodafoneThree has awarded Ericsson and Nokia a $2.7 billion contract to build the UK’s largest 5G network, a move set to reshape telecom competition.

UAE President Meets OpenAI CEO to Strengthen AI Ties

UAE President Sheikh Mohammed bin Zayed met OpenAI CEO Sam Altman in Abu Dhabi to explore deeper AI collaboration, focusing on research, infrastructure, and innovation.