trending

neon

Cirque du Soleil offers summer ticket deals

dining out

Celebs ditch the Strip for iconic Henderson restaurant

july

trending

neon

Cirque du Soleil offers summer ticket deals

dining out

Celebs ditch the Strip for iconic Henderson restaurant

july

Venture capital investments in the tech industry have reached record highs in 2025, driven by innovations in AI, blockchain, and green technology. Investors are pouring billions into startups, signaling confidence in the sector’s future growth

The U.S. tech sector is experiencing an unprecedented surge in venture capital (VC) funding in 2025. As emerging technologies like artificial intelligence (AI), blockchain, and green tech continue to evolve, investors are pouring record amounts into startups, fueling innovation and economic expansion.

Several factors have contributed to the increase in venture capital funding:

According to industry reports, total venture capital investment in the tech sector has surpassed previous records:

Top venture capital firms leading the investment boom include:

This surge in VC funding is reshaping the tech landscape:

Despite the positive outlook, the venture capital boom comes with its share of risks:

Venture capital investments in the tech industry have reached record highs in 2025, driven by innovations in AI, blockchain, and green technology. Investors are pouring billions into startups, signaling confidence in the sector’s future growth

the latest

Cerebras to Deploy AI Infrastructure at UAE Stargate Campus

Cerebras Systems, a leading AI hardware company, announced plans to deploy its advanced AI infrastructure at the UAE’s Stargate data campus.

US Approves Nvidia AI Chip Sales to UAE Amid Export Curbs

The U.S. government has authorized certain Nvidia AI chip exports to the United Arab Emirates, easing restrictions imposed under Washington’s export control policies. The decision signals a balancing act between U.S. security concerns and the UAE’s growing role in global AI development.

US Approves Billions in Nvidia AI Chip Sales to UAE

The U.S. Commerce Department has granted export licenses for several billion dollars’ worth of Nvidia AI chips to the UAE under a bilateral AI agreement, Bloomberg reports.

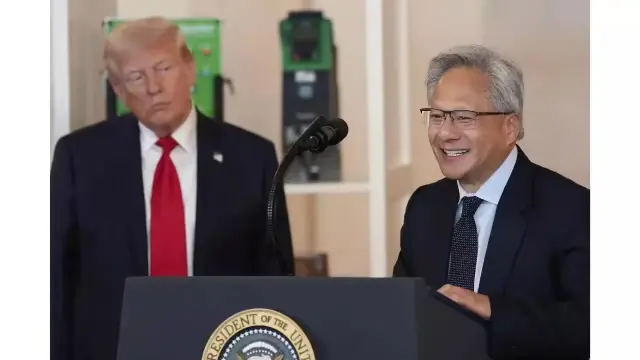

Nvidia CEO Frustrated as U.S. Delays UAE AI Chip Deal

Nvidia CEO Jensen Huang has voiced frustration over delays in the UAE’s AI chip deal, reportedly caused by U.S. pressure. The delay risks slowing regional AI expansion and complicating U.S.-UAE tech diplomacy.

Trump’s UAE Chip Deal Delays Frustrate Nvidia’s Jensen Huang

Nvidia CEO Jensen Huang expressed frustration over delays in the Trump-backed UAE chip deal, raising concerns over AI and semiconductor expansion.

UAE President, OpenAI CEO Discuss AI Collaboration Plans

UAE President Sheikh Mohamed bin Zayed met OpenAI CEO Sam Altman to explore collaboration in AI, aiming to boost innovation and digital transformation.

Nvidia CEO Frustrated by Delays in Trump’s UAE Chips Deal

Delays in Donald Trump’s UAE chip deal have left Nvidia CEO Jensen Huang frustrated, raising concerns about global chip supply chains and AI ambitions.

Ericsson, Nokia Secure $2.7B VodafoneThree UK Deal

VodafoneThree has awarded Ericsson and Nokia a $2.7 billion contract to build the UK’s largest 5G network, a move set to reshape telecom competition.

UAE President Meets OpenAI CEO to Strengthen AI Ties

UAE President Sheikh Mohammed bin Zayed met OpenAI CEO Sam Altman in Abu Dhabi to explore deeper AI collaboration, focusing on research, infrastructure, and innovation.